On Tuesday last week, Ieuan Wyn Jones announced Build for Wales, Plaid Cymru's scheme to fund infrastructure investment in Wales. The idea attracted considerable interest in the media, as well as some incredulity from Plaid's political opponents, as we can read here:

Plaid to campaign on £500m jobs fund - Western Mail, 16 March 2011

Plaid Cymru City bond idea attacked by rivals - BBC, 16 March 2011

Betsan Powys attempted to explain the issues in her blog, both here, and later here. But there were still several unanswered questions, so I asked Madoc Batcup, one of those in Plaid who has been at the centre of developing the idea over the last few years, if he would write something to explain the proposal in more detail.

Madoc Batcup is an independent financial consultant, with interests in structured financial products and in the environmental industry. He has also served as a member of the National Association of Pension Funds’ property advisory committee.

Madoc is a law graduate of Cambridge University and of the Institut d’Etudes Européennes in Brussels. Prior to becoming a financial consultant he worked for the investment banking arm of Swiss Bank Corporation in both London and Tokyo.

He is also Director of Wales in London.

BUILD FOR WALES

An Infrastructure Investment and Management Company for Wales

Plaid Cymru recently announced a ‘Build for Wales’ project to create a new entity to invest in public infrastructure. In explaining what this innovative approach is expected to achieve, it is perhaps worthwhile to look at the context and background of the constraints to public sector investment in Wales.

Although housing is currently very expensive, it is generally considered desirable for people to aspire to own a house, for most the biggest capital investment they are ever likely to make. Because it would be impossible for all but the most extravagantly wealthy of individuals to purchase a house out of their current income, and because it would take a very long time to save up the money necessary to purchase a house, a mortgage market has developed which allows individuals to buy houses and live in them as they gradually pay off their debt over a number of years.

The situation of governments is not so terribly different. If they want to undertake large amounts of capital expenditure to invest in new schools, hospitals, roads etc. they must either use current income, save until they have enough money, or borrow the money over the years and repay as they use the facility.

In the case of the Welsh Government it can’t borrow, and it can’t tax to increase its income. If it saves then it lays itself open to the possibility of the Treasury taking back the money on the basis it is unspent as it did recently - the Treasury’s housekeeping can lead to perverse incentives against prudence. So something that most individuals take for granted and is generally thought to be a good thing, the ability to borrow long term to buy an expensive capital asset and pay for it gradually, is denied to the Welsh Government.

-

It is true that Westminster came up with an alternative; PFI, which in essence is a form of glorified inefficient and expensive hire purchase. Given the lack of any alternative form of funding, many parts of the UK reluctantly undertook capital projects using PFI because they had little choice. The Treasury has now acknowledged that PFI often represents poor value for money, hence the cancellation of the Building Schools for the Future programme in England. To its credit, Wales financed very little using PFI (about one tenth of the amount of Scotland, and less than 1% of the UK total). However, this has meant that Wales has a substantial backlog of capital projects in the public sector. The announcement by the Chancellor of the Exchequer in last October’s Spending Review that the capital expenditure budget for Wales would be slashed by 41% over the next four years has added a huge amount of further pressure on already severely constrained funding.

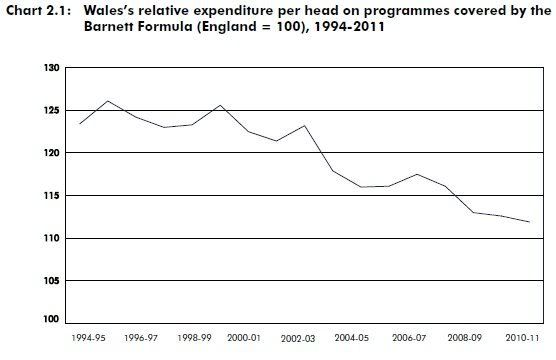

This means that the Welsh Government (and the Welsh public sector generally) has an urgent need to find an alternative way of investing in its infrastructure. In addition it must try to do so within its funding allocation under the Barnett formula given the current financial challenges which the UK faces.

It is to meet this challenge, as well as to provide a mechanism for improving public sector procurement and management and driving down costs, that Wales needs a new approach and a new entity. A Welsh Infrastructure Investment and Management company, christened as ‘Build for Wales’ (BfW) would have the following key characteristics:

• The company would be a not for distributable profit private company, limited by guarantee, with a structure comparable to that of Glas Cymru. Profits retained in the company would be used to improve the company’s balance sheet and to invest in further public sector infrastructure projects in Wales. It would focus exclusively on infrastructure projects in Wales, and as its portfolio grew it is anticipated that it would build up a substantial body of knowledge and expertise in the area of tendering and negotiation, as well as in the operation and management of public sector occupied real estate.

• The company would be responsible for the funding and implementation of public sector infrastructure projects, such as schools and hospitals, and this could also extend to roads and housing. It would also be responsible for operating them and managing them after construction. It would represent an alternative to PFI and to direct borrowing by a public sector body. The company would not seek to bundle together construction contracts and operating and service contracts, as in PFI, but only to be the landlord of the building/owner of the asset with a standard lease. In addition any profits the company made would be recycled into further investment in Welsh public sector infrastructure. This would make it fundamentally different from PFI. Public sector bodies would not be obliged to make use of the new entity, but it would provide an important funding alternative to conventional PFI and public procurement on the basis of their own spending priorities. BfW would seek tenders from private sector construction companies to deliver the infrastructure on its behalf, but BfW would be responsible for funding the infrastructure, managing it, and repaying the relevant debt under a long term lease arrangement.

The establishment of such a vehicle would enable the public sector to plan capital expenditure over a longer period, and benefit from the expertise of an arm’s length body which would be focused on the infrastructure sector and delivering value for money. In the case of building a school for example, the local education authority could ask BfW to build a school on its behalf. The LEA would enter into a long term lease to occupy the school, and the lease payments made by the LEA would service the debt raised by BfW to build the school. The LEA would be responsible for the day to day management of the premises.

Such an approach should, over a period of time, lead to standardisation in both contractual documentation and in procurement procedures and requirements, lowering costs and increasing transparency and certainty, and enhancing the likelihood of the efficient delivery of public infrastructure. For local education authorities, health trusts and other public bodies it provides access to a centre of expertise, which although private has a public sector mission, capable of delivering capital projects for them on a more efficient basis, resulting from being specialised in the sector, and being able to build on its funding and construction experience.

The aims of creating this new independent company include:

• Enabling the Welsh Government to use part of its current expenditure as capital investment in an efficient manner. This is something that the Treasury normally welcomes as being a prudent approach. Since Wales has done very little PFI compared to the other parts of the UK it has more room to invest in capital projects.

• Enabling access to private sector finance on a fairer and more efficient basis than PFI at a time of severe government borrowing constraints

• Creation of a specialist company experienced in procurement and negotiation with contractors, resulting in a more efficient delivery of public sector infrastructure projects, and the driving down of costs, another aim of the Treasury

• Profits made by the company would be retained for further investment in the public sector, another aim of the Treasury.

This approach has therefore specifically been tailored to meet a number of the Treasury’s key goals as well as the needs of the Welsh Government. It would have the added advantage of providing demand in the construction industry at a difficult time, protecting and creating jobs and investing at pricing levels which should be very competitive compared to a few years ago.

The Welsh Government would need to provide a certain amount of loan capital out of its own resources to the company to get it started and might assist the company by way of a contingent guarantee to the extent consistent with it being an independent company. The amount lent would be paid back out of retained profits after an agreed period of time.

The amount that BfW would invest in infrastructure projects would depend on the demand from the Welsh public sector, but if this amounted to e.g. £500 million over the five years after its establishment, the total annual servicing costs would be about 0.3% of the Welsh budget. This therefore actually represents a rather cautious approach to the expansion of public sector infrastructure investment.

-

The Treasury has acknowledged that PFI is not good value for money and is looking for an alternative at a time when the public finances of the UK are exceptionally constrained and yet there is the need to provide a growth stimulus, not least in the construction industry. While the Welsh Government has comparatively more capacity to transfer current spending to capital investment, this approach would be equally applicable in the rest of the UK.

This alternative to PFI has been discussed with major banking and accountancy institutions and proposals to take it further with the Treasury have been initiated by the Welsh Government. It is to be hoped that as the details of this approach become clearer, and in the seeming absence of any other researched suggestions as to how Wales as a whole might meet its future public sector investment challenges, this approach might garner cross-party support.