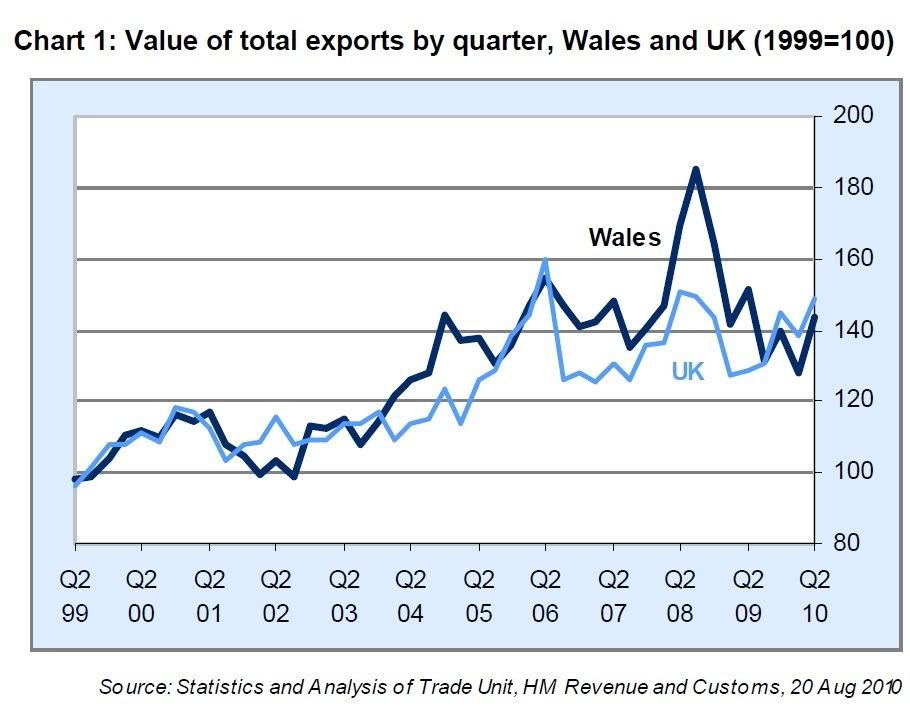

In this post yesterday, I included a graph showing Wales' export performance relative to the UK as a whole, which I'll show again:

The main thing that struck me yesterday was how much better Wales' export performance had been over the last ten years compared to the UK as a whole ... at least up to the recession brought on by the banking crisis. Yet I was still a little disconcerted by the fact that the value of Welsh exports had gone down over the last twelve months, while the value of UK exports as a whole had gone up. So I decided to dig a little deeper.

Looking at the past few years in more detail, there has been just one place where the line for Wales went down, but the line for the UK as a whole went up: between the second and third quarters of 2009. This is unusual, because the two lines tend to go up or go down together ... although not necessarily by the same amount.

Footnote 7 of the document from which the graph is taken says this:

Exports are allocated to a region by the postcode associated with a company's VAT registration. Some adjustments have been necessary for exports to the EU, to ensure that manufacturing that takes place at branch premises is properly allocated to the region where the branch is situated. Exports to countries outside the EU already contain a regional coding.

That was enough to get my interest up, for I have long argued that the statistics for items such as corporation tax and VAT are based on the location of the accounting offices of the companies concerned rather than the location of the premises where the company does its work. This means that profits made in Wales tend to be under-reported in favour of head offices elsewhere in the UK, usually in south east England. Footnote 14 makes this point explicitly:

In July 2009 the Economic Operator Registration and Identification (EORI) number will replace the Trader Unique Reference Number (TURN) as the unique identifier used on Customs declarations. Customs declarations are the largest source of non-EU overseas trade data.

The Regional Trade Statistics (RTS) methodology uses the TURN to identify branches within companies. The EORI number will not be able identify branches as they will only be issued to a legal entity – sole proprietor, partnership or company.

The move from TURN to EORI means it may not be possible to allocate all trade at branch level for the RTS. On the basis of the EORI number, there will be an increase in non-EU trade being assigned to the region of a head office rather than that of a production branch.

The last RTS publication completely unaffected by EORI was the Quarter 2 2009 RTS, published on 10 September 2009. The intra-EU regional trade data in future releases will be unaffected.

This is likely to mean that some trade that would have been allocated to branches in Wales will be allocated to the head office outside of Wales and vice versa. The Statistical Directorate will monitor and review this in conjunction with HMRC. More information can be found here.

Note the date of the change: the beginning of the third quarter of 2009.

So let's look at the actual figures, from here. The fall in Welsh exports between Q2 and Q3 2009 was £324m (a fall of 13.39%) but the corresponding rise in UK exports was £1,199m (a rise of 2.21%). It therefore seems fair to say that because we would have expected a rise roughly in line with the UK as a whole, the change from TURN to EORI has made a difference of approximately £375m or 15% of the total recorded value of our exports.

And if this is true for our exports, it seems reasonable to assume that the same pattern will apply to our trade within the UK as well.

At present, this is merely an observation based on the figures available in the documents I've linked to. It could do with some more detailed research, if anyone's up for it. But it strikes me that even though the change of accounting rules is highly retrograde (since it provides us with less detailed rather than more detailed information) it is nonetheless one of the few indicators we have of the extent to which economic activity in Wales is accounted as having been done in England.

6 comments:

If I go into Llandudno to buy a new suit tomorrow, I will probably pay VAT on that suit in England.

The assistant who sells me that suit will probably pay his or her income tax through the shop's accounting office in England, so there is no true record of how much tax is actually raised in Wales.

Of course there is a record of how most state benefits are paid in Wales. So how much Wales puts in and takes out of the British system is warped in favour of the economic argument that Wales is a net scrounger of English Taxes.

But, if we make that argument we must be honest. There aren't that many points of import and export to Wales anymore. Goods made in Wales might be easily distinguishable as exported from Wales. But the suit I buy in Llandudno will probably have been imported from China through England, so won't show up as a Welsh import.

All economic arguments for or against Welsh nationalism are futile, the data doesn't exist, and it isn't in the UK's interest to create it.

Welsh nationalism needs fire in the belly not accounts in order to succeed.

Alwyn makes a good point - independence is a leap of faith more than an appeal to the wallet. But to get there, we have to convince enough people that Wales will be economically viable. 700 years of colonialism affects the mind.

So Syniadau's revelation that exports have dropped due to an accountancy sleight of hand is important because it rebuts the Kinnockio lies that Wales cannot sustain itself.

Advocates of independence must continue to make the case that Wales can be a leader not follower of economic innovation IF it regains independence.

Alwyn, I can accept that factors other than economics are what matter to you, but that does not make all economic arguments futile. Although I think it's a rather artificial distinction, some people are influenced more by the "heart" and others by the "head" ... although life is a lot less trouble when both heart and head agree!

So yes, we need those with fire in their bellies for independence, but in order to win more people round to the idea of independence some of us must also address the cold, hard practicalities of doing it. Let us each do our part in our own way. I'll win over some, you'll win over others.

-

On a more detailed note, the point is that we do know some of the picture, but not all of it. So, in your example, you're right about VAT, but wrong about income tax. We know exactly who pays what in income tax and national insurance, so these can both be properly accounted to Wales either on a residence or workplace basis.

I should perhaps note that both this and my previous post were about Wales export figures. It was Owen who introduced the balance of payments question and, although I was grateful to him for doing that, I did point out that there were some question marks over the import side of the equation. You are almost certainly right about the point of import being a factor. However it is clear from the documents that the point of export is not a factor, because the data is based on the exporter. I found it unfortunate that people (for example on the WoL forum) have picked up on the balance of trade as such a major factor. It is not that much of a factor, because it doesn't reflect trade within the UK.

The clearest picture we have of Wales' overall balance of payments is from the Holtham Commission. Its final report arrived at a deficit of just over £6bn a year. The difference between its figure and that of £9bn from Oxford Economics is that Holtham took some account of the "head office/production location" anomalies, using the same methodology as is used in Scotland for GERS. But, for example, Holtham didn't take account of this for VAT and used estimates of retail spending instead. But that is to quibble over details that might make a difference of hundreds of millions, but not billions. In broad terms it is right to say that Wales has a deficit of just over £6bn.

What I have done in this second post is show the same "head office/production location" anomaly, but in a slightly different way. It is only a "snapshot" and it is ironic that it has only come about because of a retrograde change in the way the figures are calculated. I think that the only real solution is to require companies to produce national/regional accounts for tax purposes. This will become a necessity if Northern Ireland gets the lower rate of corporation tax that the ConDem government seems minded to pursue.

Too long for one comment, more to follow ...

Continued ...

The argument for fiscal autonomy is that it is only by controlling the levers of the economy ourselves that we in Wales can hope to change this situation for the better. Over-centralized political arrangements go hand in glove with an over-centralized economy. A one-size-fits-all solution cannot suit the City of London and the peripheral nations/regions of the UK at the same time. In quite a few countries the argument for independence is that "we're rich enough to go it on our own" but for us the argument is that we cannot become rich unless we go it on our own. The political and economic structures of the UK inevitably draw wealth to the centre, with the result that there is greater inequality between the richest and poorest parts of the UK than in any other member of the EU.

The additional financial argument for independence is that Wales would have no interest in the UK as a "world power" and therefore would not spend so much money on trying to maintain that position.

But to come full circle, Alwyn, I fully agree that independence for Wales is not just about the economy. It is also about a hundred and one less tangible, but no less important issues. Pride in our national identity and the self-confidence to make our own decisions about what matters to us as a society are, if anything, much more important than pounds or euros.

If Alwyn is wrong about income tax (and I don't doubt MH) then another factor must be considered.

Much of north Wales is 'served' from Chester, mid Wales from Shrewsbury. What this means is companies basing their 'Welsh' operations in these towns. With the resultant income tax counted as having been paid in England.

Even without independence we could greatly reduce our balance of payments by kicking up enough of a fuss about these towns' parasitic relationship with Wales to make it difficult for any outfit to persist with 'Chester & North Wales' or 'Shrewsbury & Mid Wales'.

At no cost we could create many thousands of jobs in Wales by using the simple argument: 'You want our money - then locate the jobs here!'

This isn't even about politics, or economics; it's about national pride and the refusal to be ripped off. As an example of how deservingly downtrodden we are, just ask yourself when you last saw any company or utility or whatever organised into a 'Carlisle and Southern Scotland' region.

The Jocks wouldn't put up with it, we do; and have for centuries. So 'they' do it because they can get away with it. And if we make a fuss the Kinnochios of this world damn us as 'narrow nationalists'.

I always like to quote the profits of HSBC Bank. Last year it made a profit of 1 Billion pounds - and all of the tax paid on that is credited to its head office in London. Yes this money was generated across the world, not just the UK, and so it is accountable into its UK and overseas operations. But the UK operations are not broken down regionally, and so despite Wales having 5% of UK population and hence 5% share of profit generation, none of this profit is accounted to Wales so we do not see any notional corporation tax generated in Wales. It is difficult to quantify, but is clearly incorrect and puts Wales at a disadvantage.

Penddu

Post a Comment